1

Please refer to important disclosures at the end of this report

1

1

Market view & outlook post unlock 1.0

Significant easing of restrictions by Government is positive for markets

The Ministry for Home Affairs (MHA) announced further relaxations in restrictions

on the 30

th

of May 2020. As a result we expect that restrictions will be lifted

significantly in most parts of the country which should lead to increased economic

activity from June onwards.

Markets have reacted positively to the Government’s announcement on unlock 1.0

especially on the back of a global risk on which is providing tailwinds to our

markets. The global risk on rally has been triggered by large fiscal and monetary

stimulus by major countries especially the US where the Fed has done

unprecedented monetary stimulus of USD 2.9tn since March 2020.

Easing of restrictions should help restart the economy

The Government had earlier extended the lockdown till the 31st of May 2020

though with greater relaxations which had led to increase in economic activities in

May as compared to April. The Government has now allowed more relaxations

which should provide further impetus to the economy. Some of the key changes

are listed below:

Unrestricted inter and intra state movement of people and goods except for

containment zones. Requirement of permission (e-pass) has been done away

with.

Resumption of passenger train service and domestic passenger air service.

Hotels, restaurants, other hospitality services and shopping malls will also be

allowed to open in the first phase from the 8

th

of June’20 except for

containment zones and subject to state approvals.

While there has been significant relaxations allowed by the Government some

section of the economy including cinema halls, educational institutions,

international air travel, gymnasiums, theaters bars auditoriums and metro rail

services will remain closed in the first phase of the unlocking. The central

Government in consultation with state Governments will take a call on further

opening up of the economy in the month of July.

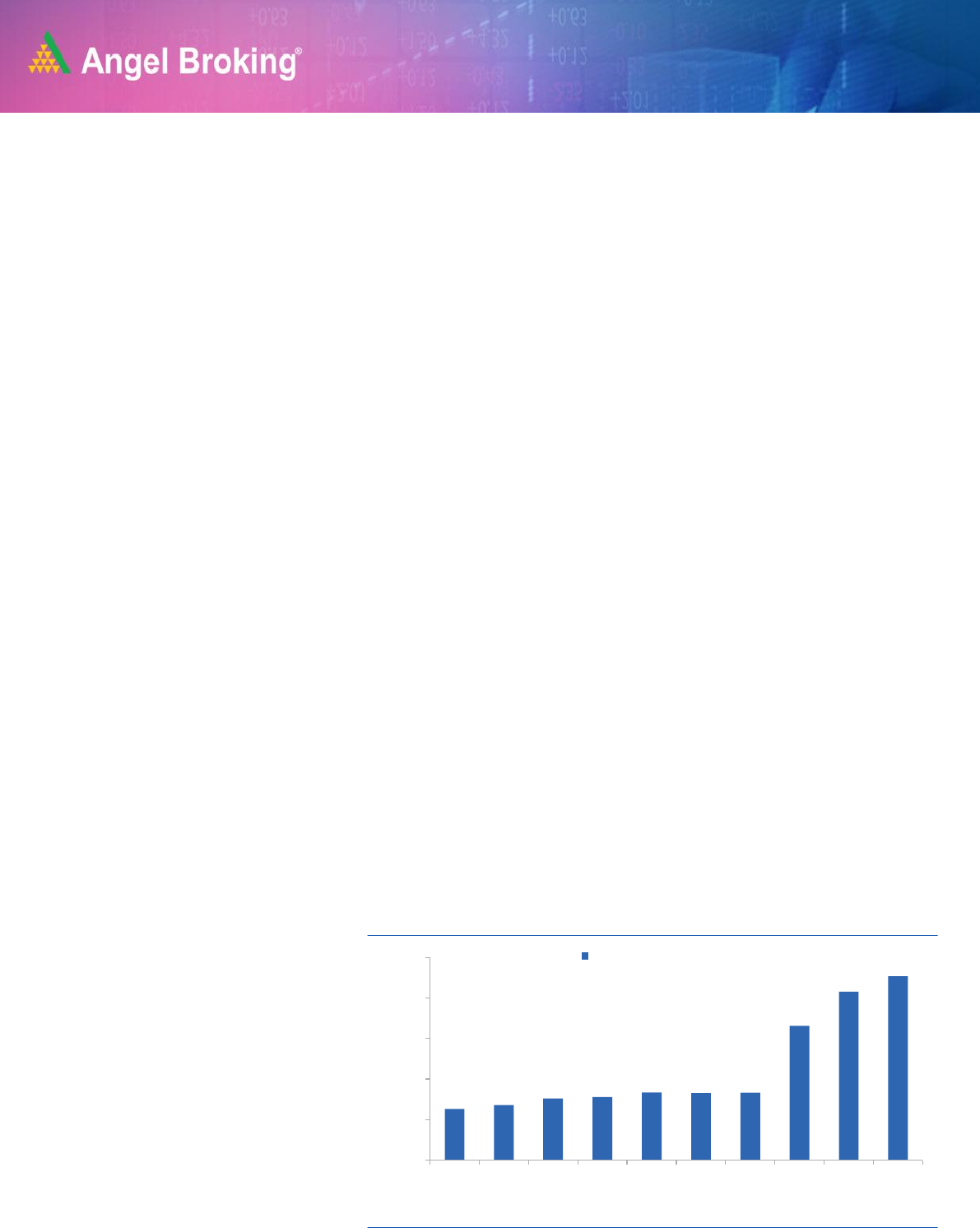

Exhibit 1: US Fed stimulus driving global equity rally

Source: Company, Angel Research

3760

3858

4020

4053

4166

4152

4159

5812

6656

7037

2500

3500

4500

5500

6500

7500

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

US Fed Balance Sheet (USD bn)

Market sentiments have turned

positive post announcement of

Unlock 1.0

US Fed induced global risk on rally

to provide tailwinds to Indian equities

Significant relaxations under unlock

1.0 will help restart the economy

Further relaxations will be allowed in

July if pandemic doesn’t worsen

Unprecedented Monetary stimulus of

USD 2.9tn by US Fed driving global

risk on rally

2

Error!

Refer

ence

sourc

June 2, 2020

2

Market view & outlook post unlock 1.0

View and outlook

As restrictions will be eased significantly from June onwards we believe that the

economic recovery should gradually improve from here on. Given the US fed

fuelled liquidity driven rally globally we believe that Indian markets will outperform

in the near term after underperforming rest of the global markets in May 2020.

We expect the rally to be more broad based and expect cyclical sectors like Auto,

banking, construction, consumer goods to outperform in the near term given

beaten down valuations.

However there has been a mass movement of migrant workers from urban to rural

areas over the past few weeks as they returned to their hometown. This is leading

to an increase in new cases over the past few weeks which is coinciding with the

opening up of the economy. While rural areas have largely remain unaffected

from the virus there is a possibility that there could be further increase in new cases

down the line if there is a spread of the virus from urban to rural areas.

While India had managed to contain the virus by enforcing one of the strictest

lockdown globally there is a possibility of a jump in new cases down the line given

increased movement of people. In that case the economic recovery will get get

pushed back as the Government will be forced to roll back some of the

relaxations. This may result in increased market volatility especially in cyclical

sectors which are leading the current leg of the rally.

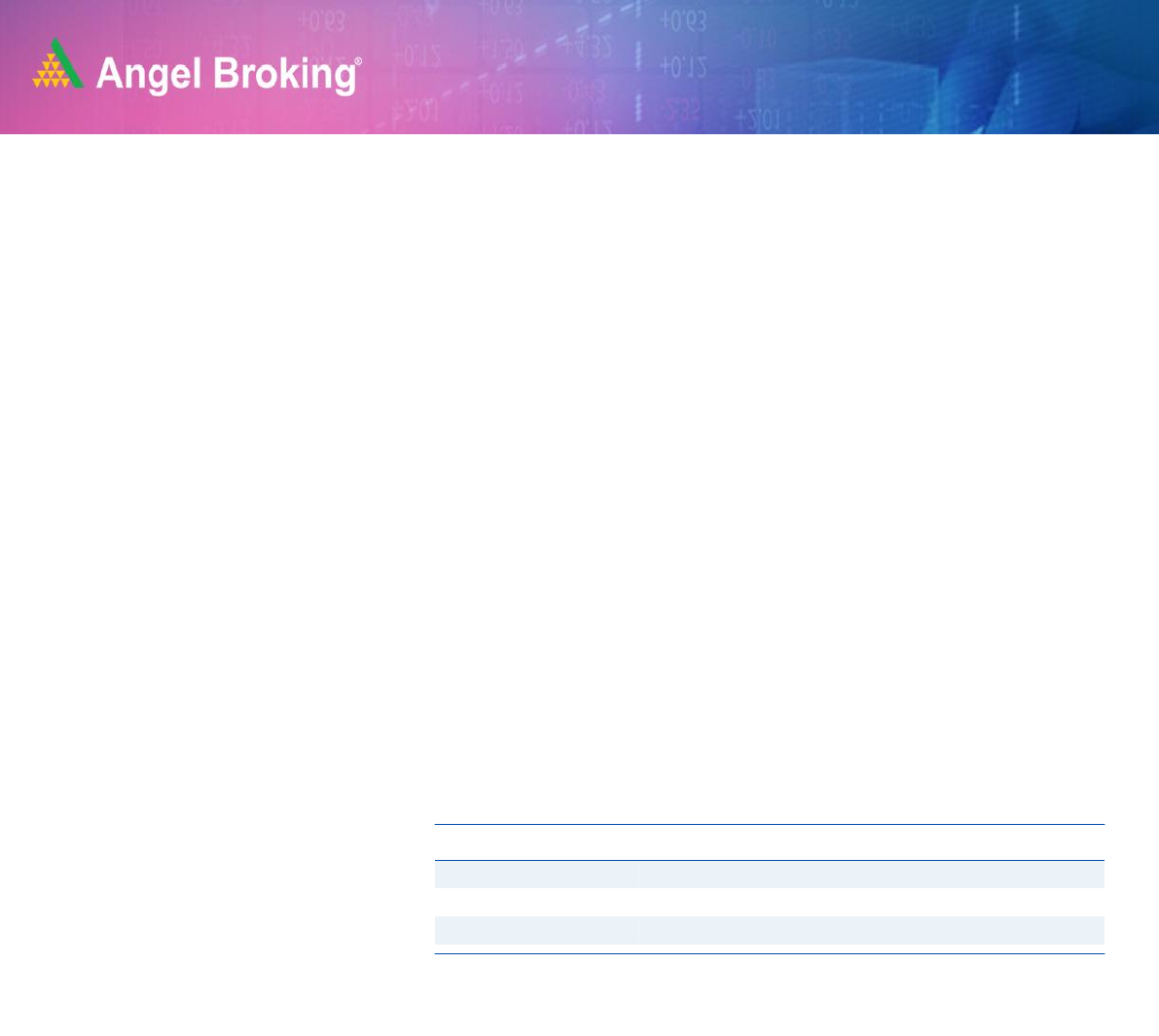

Exhibit2: Top Picks Performance

Return Since Inception (30

th

Oct, 2015)

Top Picks Return

41.4%

BSE 100

18.4%

Outperformance

23.0%

Source: Company, Angel Research

We expect cyclical sectors like Auto,

banking etc. to outperform given

beaten down valuations

Sharp increase in new Covid-19

cases in India is key risk for markets

going forward

Note: Top picks performance is as of 29

th

May, 2020

3

Error!

Refer

ence

sourc

June 2, 2020

3

Market view & outlook post unlock 1.0

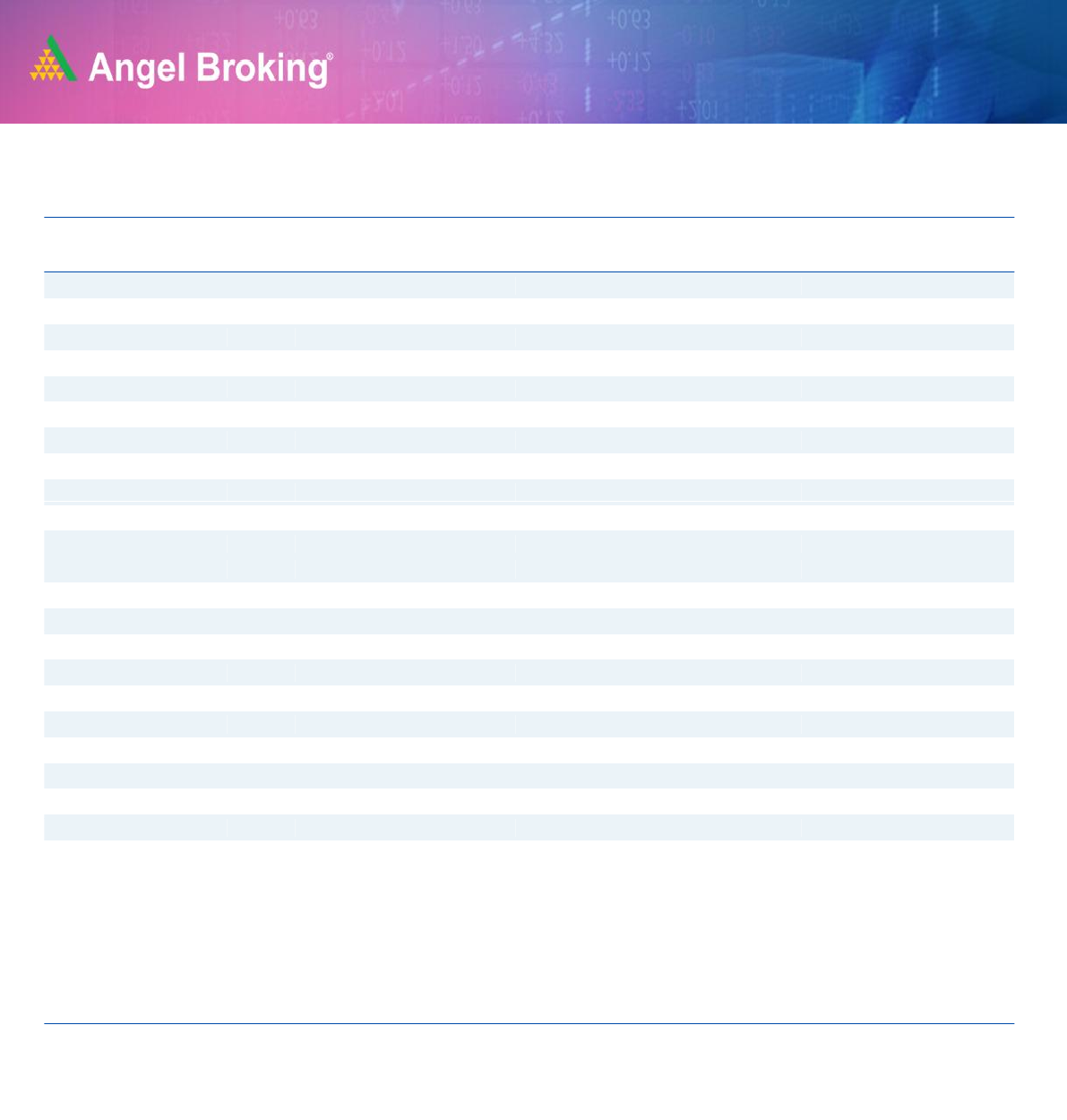

Exhibit3: List of stock recommendations

CMP

(`)

Target

Price (`)

Sales

(`)

OPM (%)

PAT

(`)

ROE

(%)

P/E (x)

EV/Sales

(x)

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

FMCG

Britannia Ind.

3,435

3,780

13,255

14,863

16.3

16.7

1622

1901

30.2

29.6

51.2

43.8

5.7

5.2

Colgate-Palmolive

1,381

1,620

4,566

4,931

26.6

27.9

786

900

40.4

37.7

47.8

41.7

8.1

7.5

Hindustan Unilever

2,106

2,364

40,778

44,855

24.6

24.8

7024

7809

64.3

61.7

63.0

56.7

12.0

10.9

Nestle India

17,157

20,687

13,235

14,558

23.3

23.4

2151

2382

66.9

50.4

67.7

61.2

12.4

11.3

P& G Hygiene

9,982

12,230

3,365

3,802

22.2

22.6

549

637

29.0

24.6

59.0

50.8

9.8

8.7

Other Consumer Goods

Avenue Supermarts

2,305

2,735

27,781

33,730

8.4

8.8

1419

1825

17.5

17.7

105.0

81.6

5.4

4.4

Chemicals/Agro Chemicals

Aarti Industries

981

1,284

4,822

5,886

21.7

22.2

538

711

16.8

19.6

32.5

24.5

3.5

2.9

Galaxy Surfacants

1,362

1,610

2,672

2,886

14.0

14.3

221

223

18.3

17.8

21.7

19.5

1.9

1.7

PI Industries

1,582

1,784

3,877

4,992

21.5

22.5

555

770

17.4

20.0

39.3

28.4

5.5

4.2

IT

Infosys

699

841

90,650

102,857

21.3

20.5

16200

17870

28.1

30.5

18.3

16.6

2.8

2.5

L&T Infotech

1,842

2,038

11,588

13,085

18.9

19.6

1611

1867

23.0

22.4

19.9

17.2

2.5

2.1

Pharma & Healthcare

Dr Reddy's Lab

3,950

4,570

18,840

20,855

23.5

24.8

2705

3137

30.5

31.7

23.7

20.5

3.4

3.1

IPCA Labs.

1,525

1,900

5,360

6,111

22.5

23.0

821

976

18.8

18.6

23.2

19.5

3.6

3.1

Telecom/ Others

Bharti Airtel

559

629

101,322

114,360

43.1

44.4

4046

8056

3.3

7.0

101.8

44.7

3.7

3.1

Reliance Industries

1,520

1,748

373,215

457,539

13.8

13.3

30272

37510

6.4

7.8

31.8

25.7

5.2

4.2

Larsen & Toubro

928

1,093

62,140

85,369

6.1

9.7

3589

7605

5.8

10.8

37.4

17.1

2.8

2.0

Banking

ICICI Bank

339

410

35,063

36,508

3.4

3.3

8,814

11,909

7.0

9.0

25.0

19.0

1.9

1.8

HDFC Ltd.

1,738

2,000

12,216

13,421

3.4

3.4

7,978

10,260

10.0

12.0

37.0

29.0

3.2

2.9

Auto

Escorts

972

1,150

5,825

6,628

11.0

11.5

526

615

20.3

22.5

22.6

19.3

1.9

1.6

Source: Company, Angel Research

Note: CMP is Closing price as of 1

st

June, 2020

For banking stock Price to book provided instead of Ev/sales

4

Error!

Refer

ence

sourc

June 2, 2020

4

Market view & outlook post unlock 1.0

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information

Ratings (Based on expected returns Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period): Reduce (-5% to -15%) Sell (< -15)